|

[?]Subscribe To This Site

|

Overcoming Fear to Thrive in the Current Downward Economic Cycle(Part 4 – March 15, 2009) How to Deal with Very “Scary” Times (Like Now)

The home foreclosure rate is escalating, unemployment is at its highest level since the 1980’s, and the DOW recently hit its lowest point in decades. What’s even scarier is that more and more financial “experts” are predicting it could get worse before it gets better. It doesn’t seem to be consistent with our ability to BeHappy! does it? Is that true for you? If so, this fourth part of the BeHappy! “economy” series will help change that, because it is all about being ready for anything that happens and taking steps to rejuvenate our thinking – which will reduce fear and improve our chances for success, as you’ll see.

Where is Our Economy Headed? Obviously nobody really knows what will happen in the future. Some people believe we’ll be back to our “normal” (positive) economy sometime within the next year; while others – like Dan Sullivan (The Strategic Coach) – believe that what we’re experiencing right now is the new “normal”, and that this is the way it’s going to be from now on. Still others – like Harry Dent (The Great Depression Ahead) – believe things will be much worse a year from now and for the next several years as we enter a prolonged period of even greater economic distress, similar to the Great Depression of the 1930’s.

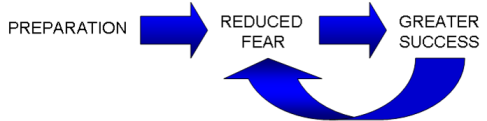

As you saw in Part 3 of this series, it is actually possible to get wealthy in the current economic cycle. Many people have done it in past recessions and depressions. Because as Charles Darwin said, "It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change." Are you going to respond to the changes proactively or sit around in fear, worrying about what might happen next? What is The Best Strategy? There are various potential strategies we could employ to get through the next few years, depending on what unfolds economically – and where we each are individually with our finances. If our economy turns around soon and heads in the positive direction over the next decade (which we all hope will happen), that implies one strategy. If, however, either Dan Sullivan or Harry Dent is right – and this is our new “normal” economy or we experience a prolonged depression – different strategies are necessary. Since nobody really knows what our economy will do over the next year and beyond, which strategy do we chose? My philosophy is ... “be prepared for anything”. It’s like someone once said, “hope for the best, but prepare for the worst”. I’ve actually changed that slightly to say, “assume the best and prepare for the worst”. The reason I say assume (rather than hope) is because hoping for the best does not compel us to take action. We can sit around and “hope” for something to happen, but do nothing to change the course of our lives. If we “assume” the best, however, we will do things – take some action, whether consciously or subconsciously – to get ready for it and perhaps, therefore, become wealthy because of our actions. Whether wealth-building is your goal or you just want to survive this economic situation, you must be ready for every possible scenario – including the possibility that it could get much worse, and stay that way for a long time. Yes, if we want to really thrive and eliminate fear over the long-term, we must be prepared - and have a plan - for all possible scenarios. Because first, preparation reduces fear by making us more confident that we can get through whatever happens. Then, as a result of less fear, we are more apt to take action – intelligent action – since we are not “paralyzed” by fear and, therefore, our chances for success increase. With less fear, we also are more able to take calculated risks, which can lead to further financial success and abundance. Then, as a consequence of greater success, confidence increases more and fear is reduced even further. It can be represented graphically like this (for those of you who are visual people like me):

It’s a “loop” that feeds upon itself to create emotionally positive feelings, which help manifest tangibly (or materially) positive results. And there’s plenty of historical evidence to support this notion. Preparation In Part 3 (and even a bit in Part 2) of this financial series, I mentioned that one of the main concepts for getting through this type of economic situation is ... cash is king. This is a basic premise of all possible strategies in today’s economy since cash can help us be better prepared for a prolonged economic recession or depression. The more cash you have, the better prepared you will be for whatever happens, and the less fear you will have about what could happen.

The “Financial Plan for a Bad Economy” you will start to design in a few minutes will help you determine what you need to be doing to get through this economic “crisis” in the best way possible – based partly on your cash position. If you don’t have any extra cash, some ideas from parts 2 and 3 of this series are: The Fundamentals:

These are things anyone can do to generate cash, and you should use some of these examples in the development of your plan. Many of these, however, require education (and involve some risk) – like investing in real estate or trading stocks and options. So don’t try anything – especially these more risky opportunities – without becoming educated on the subject first. Use your strengths to help you decide what to do and how to do it. If you do this, though, like I said, extra cash will help you be prepared. But that’s not all. The next thing to do to be prepared for anything is to manage risk. Notice I didn't say eliminate risk. Some risk could be necessary and beneficial in your individual plan – again, depending on your situation. So, what is your level of financial risk right now? Do you have significant debt? Do you own a business that is struggling – or could start to struggle – because of the current economy? Is your job in jeopardy (or have you already lost your job)? On a scale of 1 to 10 (with ‘1’ being very low or minimal risk and ‘10’ being very high – or dangerous risk level), how would you rate your current financial risk? If you put down anything higher than a ‘5’, your risk level may be too high for these times. Remember, though, that one of the ways to get wealthy in this economy is to take some risk. So there is a balance here. I would say that, depending on your cash position, the stability of your income, and your level of risk tolerance, the best risk level is between a ‘3’ and a ‘5’ on that 1-10 scale for these economic conditions. For many people, though, a risk level of ‘1’ – ‘3’ may be best – at least temporarily. For others, a risk level of '6'-'8' might be acceptable. So preparation - consisting of generating extra cash and managing risk - is the first thing to consider in developing your “bad economy” financial plan – which we’ll get to in a few minutes. But first, there is more than preparation to help reduce fear and survive – or even be successful right now. And that’s... Focus Where you focus will have a tremendous impact on both your emotional certainty and tangible success. Many people – if not most people – typically focus on the wrong things when times are tough. It’s just natural.

Where we focus will determine our reality. I know you've probably heard that before. Because as Earl Nightingale said, “we become what we think about”. In other words, “our focus becomes our reality. And it's the truth. There is no way around it. The only way to thrive in these “scary” economic times is to focus on the things we want, like:

I realize this is not always easy - especially when you’re facing a possible job loss or a home foreclosure. Whether you’re in this situation or not, though, you can still reduce your fear and survive – even thrive – in this economy. But it requires focus – the right focus. The Financial Success Plan for a Bad Economy Through the use of both of these two concepts – preparation and focus - each of us must create a plan – a detailed plan, complete with action items, goals, and contingencies – to guide us to the best outcomes for these “scary times” and for our life in general. To make it as easy as possible to build your own plan, I’ve created a Financial Success Plan for a Bad Economy “outline” for you to use. Just click on the link below to bring up the plan outline, then get out your pen and paper and fill in the blanks – or you can copy and paste it into a Word document to fill it in electronically. It’s really easy and effective at the same time. Click here to create your financial success plan for a bad economy. [NOTE: the creation of this plan requires you to be proactive and, perhaps somewhat creative. You’ll need to think “outside-the-box” a bit. You need to follow through. You must take charge – and take action. Sorry, there is no “magic wand” and nobody can do it all for you.] Click on the link above and go through the outline for creating your plan for these economic times. Write down your responses to the items in the outline. Then, create your plan and review it regularly. It will make a big difference. Religion? As I stated in my first Religion and Adversity discussion, worship - and the focus on a higher power - (i.e., religion) can be a source of strength, confidence, and support. For many people, it can help reduce fear (one of the main goals of this financial series) and help increase your sense of gratitude. I won’t reiterate what I wrote in that article, so if some kind of religious practice is not part of your life – and you are experiencing some degree of fear or pain right now – consider it as another tool to help get through this tough time. Read my brief article on Religion and Adversity, and then, if it makes sense, use this as another means to a happier life. Some Final Thoughts

Use the tools and strategies I have suggested in all four parts of this economic series - including things like expense reduction (Part 2) and income generation (Parts 2, 3, and 4). Read the related articles below by some of the people I have mentioned here – and others - to get a better understanding of how these experts view the future and the advice they give. Educate yourself. Go through the process in the Financial Success for a Bad Economy “planning guide” I have provided. And, as outlined here in Part 4, make sure to practice preparation and focus to manage yourself through these times.

Because it’s either this...

Or this... The choice is yours! You just have to eliminate your fear by being prepared for anything and staying focused on the right things. Don’t be afraid. BeHappy! my friends Related Articles and Information: The Great Depression Ahead (Harry Dent) Why the Rich Get Richer (Robert Kiyosaki) Suggested Books:

THIS CONCLUDES THE “REGULAR” PART OF MY BeHappy! FINANCIAL “ECONOMIC” SERIES. I EXPECT TO PUT OUT UPDATE ARTICLES PERIODICALLY - THE NEXT ONE PROBABLY IN THE WINTER OF 2009/2010 (DECEMBER OR JANUARY) – OR SOONER IF THINGS CHANGE SIGNIFICANTLY BETWEEN NOW AND THEN. |

Remember the scenario in Part 2 of this series, where you imagined yourself at a party with your friends six months or a year from now. How will your mood be at that party if the economy stays negative or gets worse? Will you be celebrating or stressing. It can really be up to you.

Remember the scenario in Part 2 of this series, where you imagined yourself at a party with your friends six months or a year from now. How will your mood be at that party if the economy stays negative or gets worse? Will you be celebrating or stressing. It can really be up to you.